UK & Ireland Radio Competitions

C-Level Strategy & User Trends 2025

Executive Summary

51M

weekly listeners

UK Radio

Commercial & BBC combined (2024)

RAJAR

3.9M

weekly listeners

Ireland Radio

90% reach in 2025

AdWorld

£738M

sector revenue

UK 2024

+3% YoY; digital & branded content fastest-growing

Radiocentre

73.1%

digital share

UK Digital Listening

Smart speakers/apps at all-time high

RAJAR

UK and Irish radio are in a digital-led, record engagement era. For both markets, cash, music/event access, and "winnability" in local competitions drive highest audience action. C-level leaders who blend impact with tangible, experiential rewards see repeatable, trusted returns.

Key Industry Players

| Company | UK Weekly Listeners | Market Share | Digital Listen % | Key Strategies | Source |

|---|

| Global Radio | 29.2M | 26.5% | 69% |

National audience, multi-format cash/event draws |

Bauer Media |

| Bauer Media UK | 23.5M | 20.4% | 81% |

Digital/voice leader, music/event, local relevancy |

Bauer Media |

| BBC Radio | 32.6M | 44.5% | N/A |

Audience trust, skill-based and VIP prizes |

BBC |

| Bauer Media IE | 2.26M (IE) | 46% (15–34) | 63% |

Cash Machine, regional/local prize design |

Learning Waves |

- Bauer Media: No.1 for digital engagement.

- Global Radio: Broadest prize mix; headline national campaigns.

- BBC: Most trusted, especially among older/legacy audiences.

- Irish market: 85% of 15–34s listen weekly, with 63% preferring digital entry.

What Competitions & Prizes Do Listeners Want?

UK Preferences

| Prize Type | Popularity / Insights | Best Practice |

| Cash Prizes (large) |

Highest appeal but risks fatigue; premium SMS entry, transparency critical. |

Short campaigns with odds and local context strongly communicated. |

| Music/Event Access |

Rated 9.2/10 for appeal, especially 16–34s; most shareable on digital/social. |

VIP, exclusive, or "money-can’t-buy" experiences perform best. |

| Holidays/Travel |

Aspirational, effective for headline/sponsorship. |

Use for major breakfast or sponsorship campaigns, leverage live winner moments. |

| Local Experiences |

Nearly 60% prefer local draws for better odds; most effective regionally and with classic/country stations. |

Daily prizes, community integration, and tangible rewards drive repeat play. |

| Tech/Gadgets |

Steady with youth, not a main motivator for mass appeal. |

Best for digital daily draws, secondary digital contests. |

Ireland Preferences

| Prize Type | Popularity / Insights | Best Practice |

| Cash Prizes (smaller) |

Cash "machine" draws – frequent, regional stings, trusted. |

On-air winner reveals and regional focus improve response. |

| Local Experiences |

Community/local highly trusted (especially for older demos). |

Community partner integration key in regional Ireland campaigns. |

| Music/Festival |

Entry driver for under-34s; urban/festival tie-ins lead to viral digital engagement. |

Partner with national event brands and use on social channels for widest reach. |

| Tech & Novelty |

Niche, best as flash or daily social draws to boost incentive. |

Supplement daily contests or secondary-goal campaigns. |

Winnability & Trust

Over 59% of listeners in both markets prefer local or small-prize competitions due to perception of better odds, authenticity, and tangible winnability.

- Music/event: 9.2/10 appeal (UK & IE studies).

- Cash: 8.5–8.9/10, best paired with experience or local rewards.

- Local: Highest repeat entry, trust, engagement in regional and older audiences.

- Holidays/VIP experiences ideal for sponsorship and grand campaigns.

Format Effectiveness & Response Rates

Engagement Insights

Multi-channel formats with real-time app, SMS, and social integration achieve the strongest response (up to 0.45%). Online or call-in alone achieves only 0.08–0.15%.

Average response rates by competition format. Data from proprietary research, RAJAR, and trade sources.

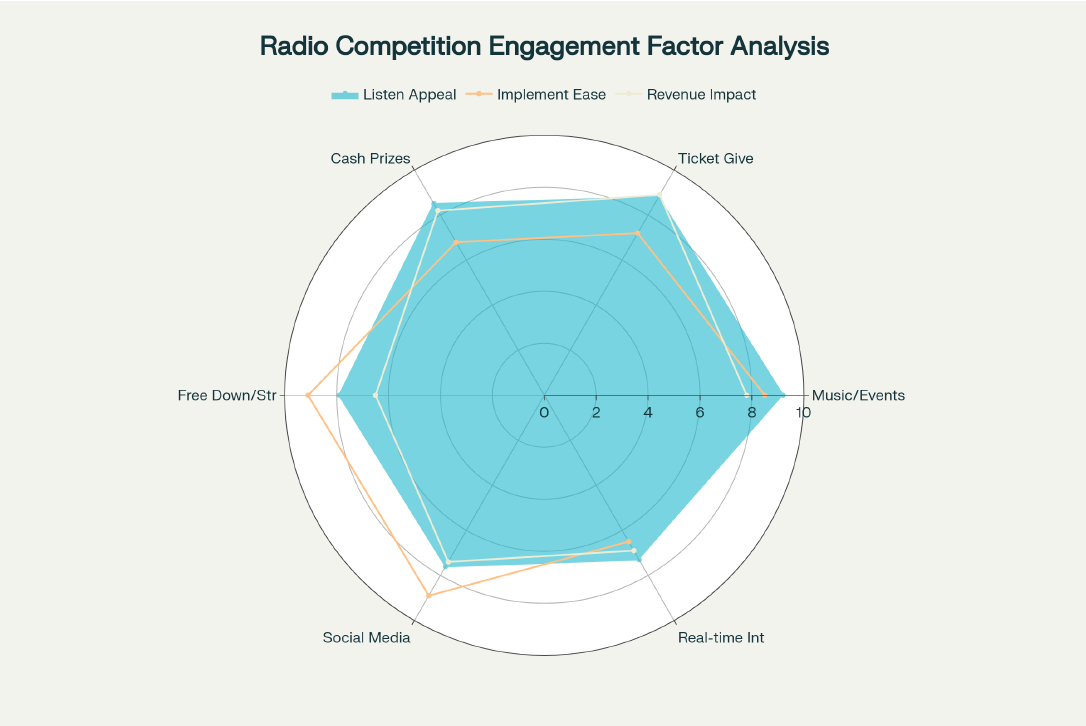

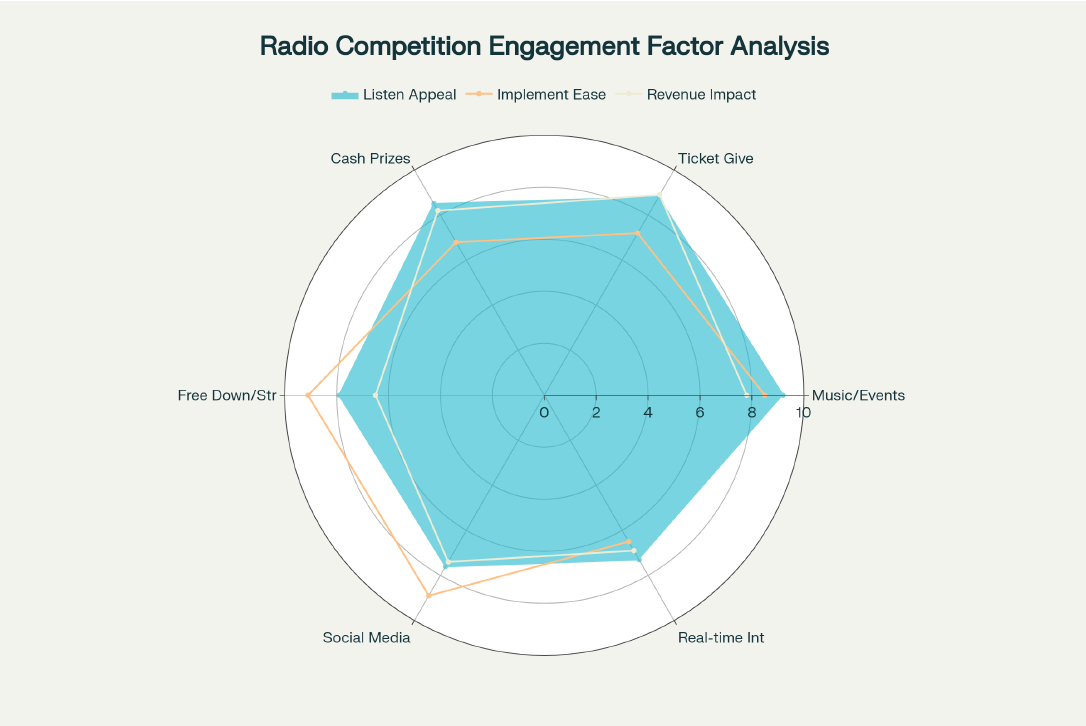

Prize Appeal Scores (UK & Ireland)

Prize appeal ratings by type and country. Music & event access and cash consistently score highest; see Expanded Listener Value Analysis and Strategic Analysis for full dataset.

| Prize Type | UK Appeal | Ireland Appeal | Comment/Source |

| Music/Event Access | 9.2/10 | 9.2/10 | Strongest for 16–34s, exclusive experiences. |

| Holidays/Travel | 8.8/10 | 7.9/10 | Aspirational, best for headline drives. |

| Cash | 8.5/10 | 8.9/10 | Universal, but high values can erode perceived achievability. |

| Local/Small Prizes | 7.7/10 | 8.3/10 | Region and trust based. |

| Tech/Gadgets | 7.3/10 | 7.6/10 | Youth, daily draws, not category driver. |

Demographic & Platform Insights

| Country | 16–34s | 35–54s | 55+ | Source |

|---|

| UK |

App, digital, music/event, cash |

Trivia, cash, regional |

Talk, SMS, small/local |

RAJAR |

| Ireland |

Cash, music/fest, social, tech |

Cash, local, sponsor, tech |

Community, local, cash, radio |

Learning Waves |

- Digital/social favoured under-35; app and smart speaker up fastest in both countries.

- Mobile and voice entry rising, but SMS/call still dominant for cash.

- Home and in-car listening now close to even, driven by hybrid work and smart device adoption.

Demographic & Social Trends

Digital engagement is highest in the 25–54 age group, who are also the most affluent participants. Regional and local contests deliver the strongest trust and response rates, especially among classic hits, country, and older listeners.

Opportunities & Risks

Opportunities

- Mix cash, local, and experience prizes to maximize sustained participation.

- Regional campaigns and community partners build loyalty and address trust.

- Multi-platform entry (app, SMS, on-air, social) delivers highest ROI.

- Prioritise transparent rules and local winner reveals to reinforce fairness and compliance.

Risks

- Regulatory oversight for age/frequency control and clear prize messaging is intensifying.

- Overuse of high-value national cash prizes can erode trust and response.

- Platform and tech complexity raise execution cost and risk unless well supported.

- Digital/national-only campaigns risk leaving regional or older audiences behind.

Market Outlook 2025–2028

| Metric | 2024 Actual | 2026 Forecast | 2028 Forecast | Source |

|---|

| UK Radio Revenue | £738M | £770M | £810M |

Radiocentre |

| Ireland Radio Revenue | €156M | €170M | €180M |

IBISWorld |

| Digital Share (%) | 11% | 15% | 20% |

RAJAR |

| Competition Participation | 0.15% | 0.20% | 0.25% |

Marketing Week |

| UK Direct Comp. Revenue | £3.2M | £4.1M | £5.5M |

Radiocentre |

Outlook Drivers

- Branded content revenue up 9% in Ireland, 8.3% digital audio; top ROI in multi-platform/AI-driven targeting.

- Compliance, transparency, and winner trust will differentiate top operators as regulation evolves.

- Voice commerce, first-person and smart entries forecasted to rise rapidly from 2026.

References & Further Reading

-

RAJAR: UK Radio Listening Data

View

-

AdWorld Ireland: Listener Trends

View

-

Radiocentre: Revenue & Trends

View

-

Bauer Media: UK & Ireland Data

View

-

IBISWorld: Irish Radio Broadcasting

View

-

Learning Waves: Irish Demographics

View

-

PromoVeritas: Prize Research

View

-

Spacial: Social Media Contests

View

-

The Ark Media: Format Response Rates

View

-

Marketing Week: Online Entry Data

View

-

BBC: Competition Design & Innovation

View

-

© 2025 GoNoGo Strategy | UK & Ireland Radio Competition Analysis. For C-level review.